Energy Blog: Leading the EV Charge

Energy Blog: Leading the EV Charge

As more and more electric vehicles enter the market, the race is on to see which countries will take the lead in key technology development.

Electrification continues to accelerate, but there could be some uneven roads ahead. On the sales front, electric vehicles are booming in their major markets. In 2024, 17 million EVs were sold worldwide, compared to nearly 14 million in 2023, according to the International Energy Agency (IEA). That equates to more than 20 percent of the annual global car market, the agency noted in its latest “Global EV Outlook,” published in May.

That performance is continuing into this year, as the report noted that first quarter 2025 global EV sales are already showing 35 percent year-over-year growth, thanks in large part to better affordability.

As for where these vehicles are going, China remains the EV adoption leader—more than 11 million EVs were sold in the Chinese market alone in 2024, which also represented about half of all the country’s car sales, the IEA reported. China is also ahead when it comes to manufacturing, the study said, as the nation produces more than 70 percent of EVs worldwide.

Meanwhile, the United States and Europe are seeing some slowdowns. U.S. EV sales were up 10 percent year-over-year, but that could slow substantially, given that 40 percent of EVs sold (around 600,000) are imported and the threat of an additional 25 percent tariff on imported cars and components looms, the report stated. While the U.S. situation plays out, over in Europe, EVs still account for 20 percent of sales, but that is slowing amid expiring policies and subsidies.

Discover the Benefits of ASME Membership

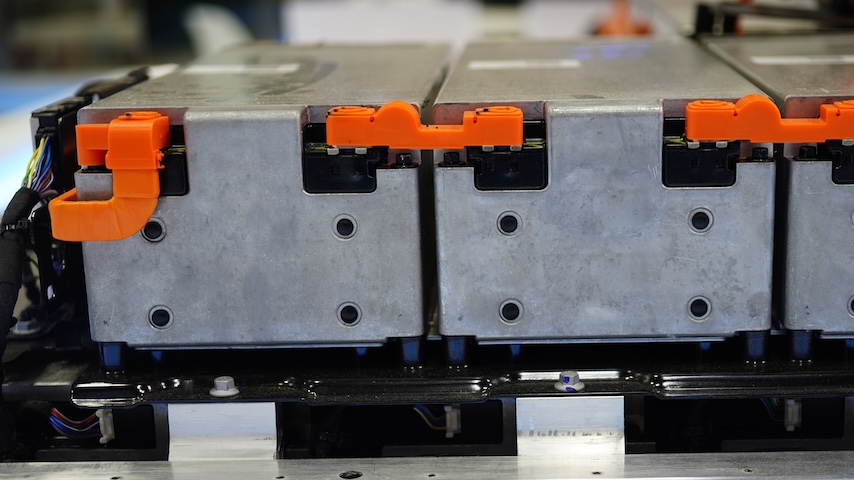

As quickly as the economic landscape is evolving, another race is on to stay ahead of the EV battery innovation curve, with some clear parallels taking shape between the markets and R&D.

A team of researchers from the University of Cambridge, University of Münster, Fraunhofer Research Institution for Battery Cell Production, Helmholtz Institute Münster, and University of Glasgow analyzed more than 32,500 patent families across six future battery technologies to determine the dynamics of geostrategic competition and regional positioning. Of course, better tech means lower costs, better range, and faster charging—but a “dominant position in these technologies [also] offers the opportunity to shape future battery supply chains and enhance countries’ strategic autonomy.”

These findings were detailed in “The geostrategic race for leadership in future electric vehicle battery technologies,” published in Energy & Environmental Science in May.

According to the researchers, “China leads in the number of patents across all six technologies,” and together with Japan and South Korea, these three countries account for about 85 percent of all EV battery patents. The reason? These nations prioritize policies that drive battery innovation and investment. Japan and South Korea are focusing more on high-energy next-generation batteries, while China is pursuing high-performance, high-energy-density, and low-cost batteries, the team highlighted.

This is leading to a “growing global innovation imbalance,” the researchers found, noting that Western regions in particular need to “reassess competitive strategies,” as they currently are more focused on “developing domestic markets for established lithium-ion battery technologies and gaining more control over today’s battery supply chains.”

Ultimately, this innovation gap will widen, the team noted, thanks to “increasing disparities in technological capabilities, potentially jeopardizing geostrategic autonomy for some regions. Tailored policies and targeted investments in Europe and the United States are essential to achieve competitive positioning, enhance technological autonomy, and meet climate neutrality goals.”

The Cambridge and Münster-led research team emphasized that a “shift in European and U.S. policy should not only prioritize increased investment in future battery technologies, but also, crucially, establish mechanisms to foster collaboration with leading companies in Asia.” Otherwise, both Europe and the United States are at risk of falling even further behind.

Fostering technology advancements with the right incentives plays a vital and obvious role in vehicle affordability, which will continue to be critical to further advancing EV adoption. Today, two-thirds of all EVs sold in China are cheaper than conventional vehicles before incentives, while in the United States, EVs are still 30 percent more expensive, the IEA noted. Operating an EV remains cheaper across most markets as well, the agency emphasized: “Even if oil prices were to fall as low as $40 per barrel, running an electric car in Europe via home charging would still cost about half as much as running a conventional car at today’s residential electricity prices.”

Looking ahead under the current policy landscape, the IEA estimates that there could be as many as 225 million EVs worldwide by 2030. However, which markets will see the most benefits and impacts will of course depend on how policies and investments evolve across key geographies over the next five years.

Louise Poirier is senior editor.

That performance is continuing into this year, as the report noted that first quarter 2025 global EV sales are already showing 35 percent year-over-year growth, thanks in large part to better affordability.

As for where these vehicles are going, China remains the EV adoption leader—more than 11 million EVs were sold in the Chinese market alone in 2024, which also represented about half of all the country’s car sales, the IEA reported. China is also ahead when it comes to manufacturing, the study said, as the nation produces more than 70 percent of EVs worldwide.

Meanwhile, the United States and Europe are seeing some slowdowns. U.S. EV sales were up 10 percent year-over-year, but that could slow substantially, given that 40 percent of EVs sold (around 600,000) are imported and the threat of an additional 25 percent tariff on imported cars and components looms, the report stated. While the U.S. situation plays out, over in Europe, EVs still account for 20 percent of sales, but that is slowing amid expiring policies and subsidies.

Discover the Benefits of ASME Membership

As quickly as the economic landscape is evolving, another race is on to stay ahead of the EV battery innovation curve, with some clear parallels taking shape between the markets and R&D.

A team of researchers from the University of Cambridge, University of Münster, Fraunhofer Research Institution for Battery Cell Production, Helmholtz Institute Münster, and University of Glasgow analyzed more than 32,500 patent families across six future battery technologies to determine the dynamics of geostrategic competition and regional positioning. Of course, better tech means lower costs, better range, and faster charging—but a “dominant position in these technologies [also] offers the opportunity to shape future battery supply chains and enhance countries’ strategic autonomy.”

These findings were detailed in “The geostrategic race for leadership in future electric vehicle battery technologies,” published in Energy & Environmental Science in May.

According to the researchers, “China leads in the number of patents across all six technologies,” and together with Japan and South Korea, these three countries account for about 85 percent of all EV battery patents. The reason? These nations prioritize policies that drive battery innovation and investment. Japan and South Korea are focusing more on high-energy next-generation batteries, while China is pursuing high-performance, high-energy-density, and low-cost batteries, the team highlighted.

Electric Geography

The switch from gasoline-fueled automobiles to electric vehicles threatens to overturn the auto industry. Will the industry’s center of gravity shift as well?

This is leading to a “growing global innovation imbalance,” the researchers found, noting that Western regions in particular need to “reassess competitive strategies,” as they currently are more focused on “developing domestic markets for established lithium-ion battery technologies and gaining more control over today’s battery supply chains.”

Ultimately, this innovation gap will widen, the team noted, thanks to “increasing disparities in technological capabilities, potentially jeopardizing geostrategic autonomy for some regions. Tailored policies and targeted investments in Europe and the United States are essential to achieve competitive positioning, enhance technological autonomy, and meet climate neutrality goals.”

The Cambridge and Münster-led research team emphasized that a “shift in European and U.S. policy should not only prioritize increased investment in future battery technologies, but also, crucially, establish mechanisms to foster collaboration with leading companies in Asia.” Otherwise, both Europe and the United States are at risk of falling even further behind.

Fostering technology advancements with the right incentives plays a vital and obvious role in vehicle affordability, which will continue to be critical to further advancing EV adoption. Today, two-thirds of all EVs sold in China are cheaper than conventional vehicles before incentives, while in the United States, EVs are still 30 percent more expensive, the IEA noted. Operating an EV remains cheaper across most markets as well, the agency emphasized: “Even if oil prices were to fall as low as $40 per barrel, running an electric car in Europe via home charging would still cost about half as much as running a conventional car at today’s residential electricity prices.”

Looking ahead under the current policy landscape, the IEA estimates that there could be as many as 225 million EVs worldwide by 2030. However, which markets will see the most benefits and impacts will of course depend on how policies and investments evolve across key geographies over the next five years.

Louise Poirier is senior editor.